Hello, and welcome! Do you want to be free again and get your finances under proper management?

If you’re here, you are a Kia finance loan holder seeking to pay off the loan faster and save money and frustrations. Financing your Kia auto loan can be done,e, and this post will provide a clear guideline for going about it.

This guide will help you understand the most effective ways, tools, and resources to pay off your Kia finance loan and provide some tips.

Let’s get started!

Lot’s of Contents

Understanding Your Kia Finance Loan

To proceed with paying off a Kia loan, it is crucial to understand the Kia finance loan process.

Kia Finance Loan Basics

A Kia finance loan is a loan to help you acquire a new or used Kia model. It is the funding subsidiary of KMA that offers buyers different kinds of credit products. These s have term agreements, usually 36 to 72 months, which may sometimes extend to more.

Part of governing the loan would be the rate of interest charged, current payment structure, and total sum of the loan.

Workflow of the Kia Motor Finance Payoff

When you’re looking to pay off your Finance loan, the process usually involves the following:

- Checking your loan balance

- Reflecting on your monthly payment plan

- Knowing any charges that are believed to be paid when making early repayments

Why Pay Off Your Kia Loan Early?

Kia borrowers need to know that it has several advantages to early repayment. Some of these in e:

- Improved credit score: In most cases, paying off other loans or even your Kia finance loan suits your credit score and will help you get a better deal next time you need another loan.

- Interest savings: So long as the loan is repaid fully and at the appropriate time, the earlier the loan is repaid, the lesser the interest charged.

- Increased financial flexibility: Do not make monthly car payments, as the remaining amount, meant to pay other bills, will hardly be enough.

Step 1 Review Your Loan Terms

The first of the steps of the payoff process that many consumers must take is to read over their current loan contract. Here’s what to check for:

- OutsHere’sg loan balance: I need to know how much your Kia loan is still fantastic.

- Interest rate: This helps you understand the interest charged on your loan. To determine the interest charge, you can compare the current rate with the one arrested for different periods.

- Loan term: Therefore, do not fail to read your loan term. It will help you calculate the remaining numbers and the monthly amount you are expected to make.

Early Payment Fees

It’s important to note that some loans attract payment costs. If you opt for early repayment of the loan before the stipulated period or tenure you agree on, you will incur certain extra charges. If you wish to make early payments on your loan, it is important to talk to Kia Motor Finance to find out if there are pertinent fees that you need to pay.

Step 2 Make Extra Payments

Before exploring ways of repaying your Kia finance loan quicker, the most straightforward method is to pay more than required in the form of monthly instalments rather than paying the extra amount to the principal amount borrowed. Here you can do it:

- Round our payments: It may be helpful to round up your monthly payment amount to the nearest hundred to add to your Payment towards the principal.

- Make bi-weekly payments: It is better to make one Payment in a month, so if you decide to pay your bills every two weeks, split your Payment into two. This method enables maki n additaddition whole every year.

Lump-Sum Payments

Another method is to make regular upfront payments where possible. These are one-time amounts, tax returns, bonuses, or any other additional income that can wipe out a considerable portion of your loan.

Step 3 Refinance Your Kia Loan

If you still enjoy a high interest rate, consider availing the Kia finance loan refinancing. Therefore, refinancing focuses on repayments by swapping your previous loan for a more favourablee term. This could lead to smaller instalmentsor a lower interest rate. It could also extend the duration period of tighter collection standards.

Here’s how to do it:

- Understand fees: Refinancing should not attract many charges that cancel out the gains that will be rereaHere’s

- Check your credit score: A higher credit score enables one to obtain improved refinancing terms.

- Compare rates: You can decide to refinance based on your current situation; however, you must do so appropriately to get the best rate. Auto loan refinancing is available through provider organizations, including traditional banks, credit unions, and other Internet-based organizations.

Step 4 Pay More Than the Minimum Payment

However, try as much as possible; more than the minimum will significantly affect the card. Interest charges are also high if you have a loan; therefore, spending more money on the loan monthly will reduce the principal balance and the interest computation period faster.

Here are some ideas to increase your payments:

- Cut unnecessary expenses: Look for places wtoreduce your costs and channel that money toward your car payments.

- Increase your payments by 10-20%: To achieve this, P payment realizes that even a slight difference between two instalments dramatically affects the total loan amount within the debt cycle.

- Use bonuses or raises to make lump-sum payments: Every time you are promoted at work or receive a bonus, bring it to Kia and pay more toward your loan.

- The following video explains: Step 4, Pay More Than the Minimum Payment

Step 5 Set a Payoff Goal and Timeline

Knowing your specific goal can also help you stay on track. Please choose the date you want to clear our Kia finance loan, and it’s desirable to map out how you will get there.

Set Milestones

You should always divide your target or goal into further achievable ones.

For example:

- 6-month milestone: You must repay at least 10% of the loan dues.

- 12-month milestone: Cut it down to 75% of the borrowed balance.

- 24-month milestone: Make at least 50 per cent of the total loan amount.

By doing this, you will ensure that you know what is being done. Think of it as keeping track of where you are and what measures to take to reach a higher level.

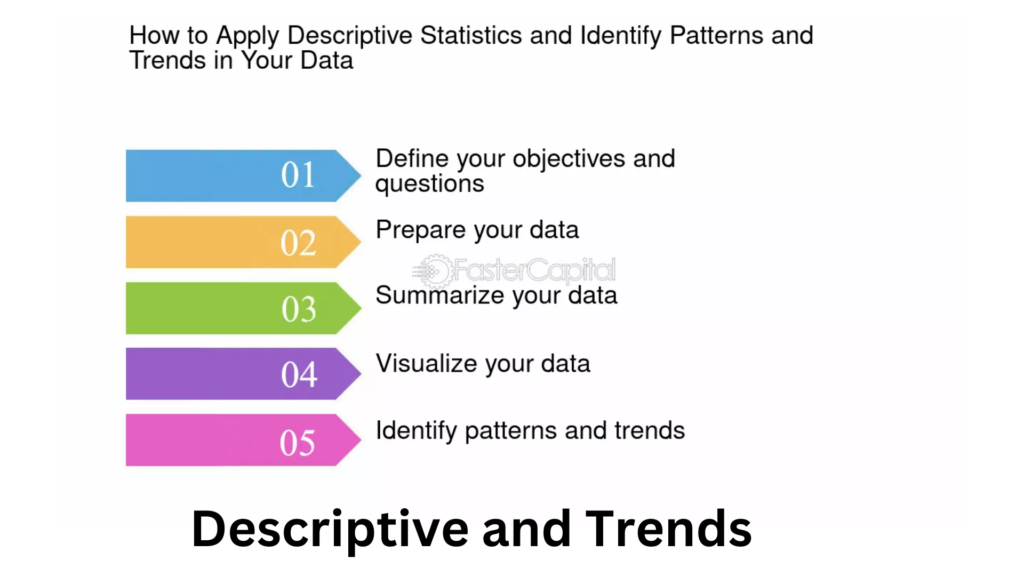

Descriptive and Trends

Several drivers are interested in saving time on auto loan repayment. The Q2 2023 State of the Automo Finance Market revealed that the average contract duration of auto finance in the US was 69.3 months, while new vehicle buyers borrowed approximately $39,500 to finance the assets. This trend demonstrates that many motorists are stuck with long-term loans; hence, early loan repayment is perhaps welcome.

Also, data from 2023 found that several auto loans can be refinanced in the United States by the National Credit Union Administration to reduce interest rates with approximately 12% of the auto loans refinanced in 2022 and still rising.

Conclusion

Early payoff of a Kia finance loan entails a few strategies, self-discipline, and viable payment process strategies. Choosing terms, additional pay refinancing options, and providing particular tools can help lessen loan balance and interest rates. It can be attained, and by following the guidelines in this guide, you can regain your financial independence.

Are you ready to do Kia finance loan redemption and be financially free?

FAQs

1. How can I pay my Kia finance loan?

To repay your Kia finance loan early, you only have one option—pay your loan principal in higher amounts than your specific payment on your car.. finanPaymenthis Paymenta round-up payment, ents, or Pants made Payments bonuses and tax refunds.

2. Is there any form of punishment to pay my Kia finance loan before the agreed time?

In most cases, Kia Finance does not penalize early repayment, though it would be wise to consult your loan contract. You should understand that some agreements may contain clauses requiring you to pay more if you want to repay your loan beforehand.

3. How do I refinance a Kia finance n?

If you want to refinance your Kia finance loan, check the checklist score to ensure you get the correct rates. Next, consider loan offers from various credit institutions, such as banks, credit unions, and online lenders.