Hello and welcome! If you are searching for the best source to learn how to get a Kia car loan for your car purchase in 2024, you are on the right track. Kia finance rates are not fixed, but they differ from one another based on credit score, terms of the loan, and any other existing offers.

If you want to know about the best Kia loan deal or are completely stumped about the world of Kia financing, then this article is perfect for you. Here, we’ll look at the Kia financing rates for 2024, the existing loan promotions, and how to get the most out of Kia’s special car financing offers.

Without further ado, welcome to the 2024 Kia financing guide, where you’ll find valuable information about Kia automotive financing.

Table of Contents

What Are Kia Finance Rates?

Kia finance rates, as pertains to automobiles, mean the interest rate that a client is charged when they use Kia finance facilities to finance the car. The rate is stated in percentage, and it also varies according to the terms of the loan and your credit score.

Kia has regular and promotional rates depending on your creditworthiness or credit score. Some companies provide special financing options as publicity tools, generally in the shape of APR 0%, for a given period or on selected models.

Kia Financing Factors

| Factor | Impact on Interest Rate |

|---|---|

| Credit Score | Higher credit score = Lower interest rate |

| Loan Term | Shorter term = Lower interest rate |

| Down Payment | Larger down payment = Lower interest rate |

| Model and Promotion | Promotional rates can be significantly lower than standard financing rates. |

Kia Financing Rates 2024?

Today, Kia has improved its financing rates, and it will introduce several Kia loan offers regarding different models by 2024. Here’s a breakdown of what you can typically expect:

Standard Financing Rates

- The APR is from 3.99% to 5.99% for the 36-month loan term, depending on the customer’s credit score.

- For a 60-month loan, rates could vary between 4.49% and 6.49%.

The above rates are offered to those buyers who have good to excellent credit history.

Special Financing Offers

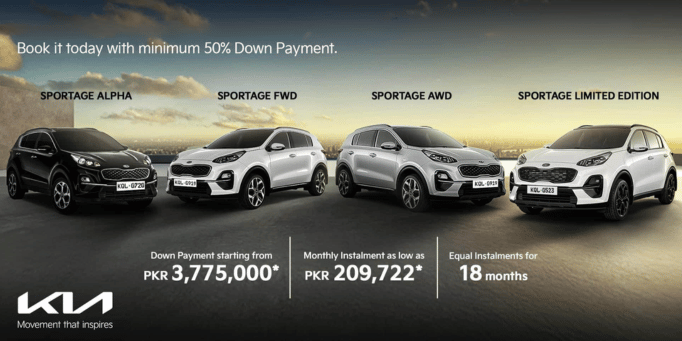

0% APR for 36 to 72 months could be offered to stable car models such as Kia Forte or Kia Sportage; some Kia loan offers are directed to those who want to buy a Kia car.

Cash rebates or low APR offers for models closer to $1,000 are also available on extremely popular models such as the Kia Sorento, Kia Telluride, and Kia K5.

Leasing Rates

It also allows leases with special interest rates starting from 0%, which enables customers to lease a car with little cash initialisation and very nominal monthly instalments.

These are variable rates, and it is advisable to check out Kia Finance, which is obtainable on the company’s homepage or, better yet, with your nearby Kia dealer.

Kia Finance Rate Deals

If you want to get the lowest Kia financing rate in the year 2024, then you have to plan and know what is likely to affect your loan terms most. Here are some steps to help you get the best deal possible:

Check Your Credit Score

Your credit score is also very important in deciding what interest rate you will be offered. The more creditworthy you are, the higher your likelihood of securing Kia special finance deals like 0% APR deals.

Credit scores above 700 are deemed more favourable for getting the best financing deal than any score below that.

Consider Loan Terms

You were considering that the longer the repayment period, the higher the interest rate, short-term car loans, which include the 36—and 48-month periods, attract less interest. However, you should note that in order to achieve short loan terms, you will have to pay high monthly instalments.

Introducing shorter loan terms such as 60 months or 72 months, you will see that although the interest rate is just a tad higher, the monthly payment is rather small, thus ideal if you are operating under a small budget.

Make a Larger Down Payment

An increase in down payment decreases the cost that you are likely going to be charged and thus leads to low del easy payments as well as low interest rates.

The down payment required ranges from 10 % to 20 %, with lenders usually preferring the 20% down payment as they stand to benefit most from the deal.

Shop Around for the Best Deal

If you’re indecisive about which dealership to choose, try comparing rates from another source, such as Kia Finance and other financing companies.

The only primary option remains to request a better offer from the dealer than the one available from another dealer.

Look for Special Promotions

New car dealers such as Kia regularly offer promotional offers during their dealer financing offers, which commonly occur during certain seasons, such as the Kia Summer Sales Event or the Holiday Specials.

As I mentioned earlier, if you are careful when you take your car, there is always a special offer that will reduce your credit rate.

Kia Loan Deals: Best Offers in 2024

More specifically, with regards to Kia loan deals in 2024, Kia has several great choices to help you get behind the wheel of your new or used car. Let’s take a closer look at some of the best Kia financing rates and offers for 2024:

Visit the Kia Website

Begin your search by going to the Kia company website or the Kia dealer from whom you wish to make a purchase.

Most dealerships recommend and offer the opportunity to fill out the application online to speed up the approval process.

Fill Out the Application

Please complete the online questionnaire, which requires you to provide some personal information, details of employment, and financial records.

You may need your social security number, income, and employment history.

Get Pre-Approved

After having recommended this Application, Kia will respond to whether one qualifies for financing.

If approved, you will be given an interest rate and loan term consistent with the application’s approval.

Finalise the Deal

Once Kia approves your credit, you should come to the dealership with all the necessary paperwork to seal your Kia financing officially.

When you buy your new car, you will also be presented with Kia lease financing, where applicable.

Conclusion

Kia finance rates in 2024 continue to be affordable, and attractive offers on new popular models are commonly provided for credit-worthy buyers.

This article has explained how Kia financing works, how to check your credit score, and how to prepare for the loan application in Launceston so you can get the best Kia financing offer and drive home in your dream Kia car.

It is also important to visit the Kia financial services website regularly to learn of any Kia loan promotions so you can effectively grab good Kia financing deals and decrease the amount of interest charged on your car.

If you read this and want to know how to get a Kia auto finance, Kia lease financing, or some tips to get approved fast, then you’re on the right page.

FAQ

1. What is the currently valid Kia finance rate in 2024 with which Kia Motors Corporation finances its vehicles?

The Kia finance rates in 2024 vary from 0% to 5.99% if you have a good credit history and the term of the loan. Kelley Blue Book has pointed out that Kia provides some of the best current incentives possible, including 0% APR for up to 72 months for models like Kia Forte and Kia Sportage for customers with a good credit rating. Promotion-related financing offers, such as cashback or lower interest rates, are also offered at certain times.

2. What does one have to do to get the best Kia financing rates?

In its current status, you should have a good to excellent credit score for Kia financing to get the best rates in the market, which is usually above 700. A higher credit score results in lower interest rates when borrowing money.

Further, if you make a big down payment, then the repayment amount can be slashed, and with this goes the rate. Consider requesting shorter loan periods, preferably 36-48 months, since most of them have lower APRs.

How do I obtain Kia financing?

Indeed, Kia financing has made it possible for people to apply for Kia financing through Kia’s official website and your local dealership website. The process is simple: complete a credit application that entails writing personal and financial information and receiving a pre-approval in minutes.

After that, you can complete the loan at the dealership, where you will be offered the loan packages that you accepted and decide on the most suitable ones for purchasing a new car.